Tax Prep Chicago

Chicago’s 2024 free tax preparation assistance program is happening right now at 7 locations citywide.

This program is more important than ever with the opportunity for filers to claim the federal and Illinois Earned Income Tax Credit (EITC) as well as the federal Child Tax Credit (CTC). This year, additional populations over 18 and who have an ITIN are eligible for the Illinois EITC. Eligible Chicagoans could receive up to $7,430 from the federal and state Earned Income Tax Credits, in addition to other credits.

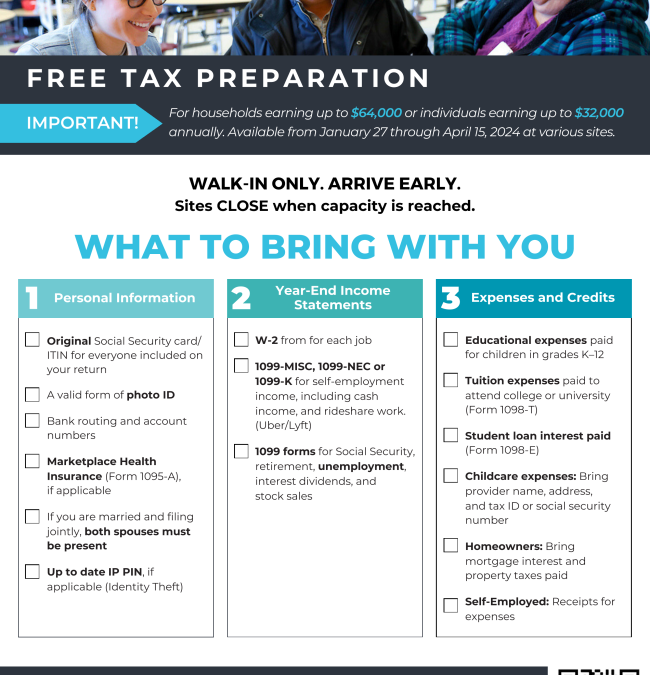

Families earning up to $64,000 or individuals earning up to $32,000 are eligible to take advantage of the free and confidential Tax Prep assistance at 7 sites across Chicago. Volunteer tax preparers certified through IRS-approved training will assist them with federal and state income tax returns. Most sites will be open now through April 15th, but please refer to the links below for specific information on the location and hours of the sites.

For more information about how to access free tax assistance, Chicagoans can:

* Call or text the City’s 2-1-1 helpline

* Visit the City’s tax assistance website at www.TaxPrepChicago.org

* Visit Ladder Up at www.

* Visit the IRS at www.irs.gov and type “free tax help” in the search box or call (800) 829-1040 I (800) 829-4059 (TDD)